Government loan schemes for women are introduced to support financial independence and entrepreneurship among women in India.

These schemes help women start or expand small businesses with affordable interest rates and flexible repayment options.

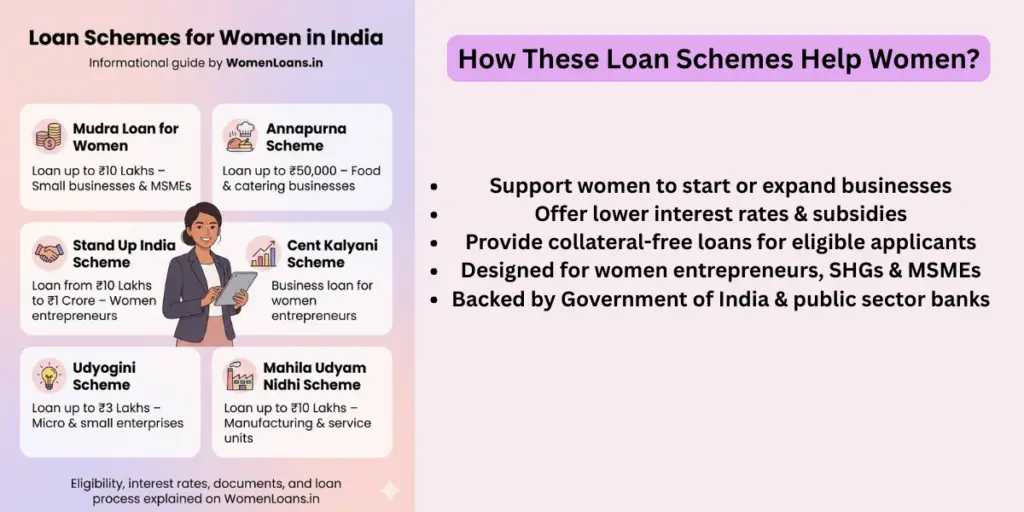

Popular schemes include Mudra Loan, Stand-Up India Scheme, Annapurna Scheme, and Udyogini Scheme.

Many of these loans are collateral-free and have simplified eligibility criteria.

They are especially beneficial for women from rural, semi-urban, and economically weaker backgrounds.

List of Government Loan Schemes for Women in India

- Stand Up India Scheme

- Pradhan Mantri Mudra Yojana (Mudra Loan)

- Udyogini Loan Scheme

- PNB Mahila Udyami Scheme

- Annapurna Scheme

- Cent Kalyani Scheme

- Stree Shakti Yojana

- Self Help Group (SHG) Bank Loan Scheme

Mudra Loan Scheme for Women

The Mudra Loan Scheme for women supports small and micro businesses by providing collateral-free loans through banks and financial institutions.

It helps women start or expand businesses in manufacturing, trading, and service sectors.

The scheme is divided into Shishu, Kishor, and Tarun categories based on the stage of business.

Loan funds can be used for equipment purchase, raw materials, or working capital needs.

This scheme promotes self-employment and financial independence among women entrepreneurs across India.

Stand-Up India Scheme for Women

The Stand-Up India Scheme encourages women to establish greenfield enterprises in manufacturing, trading, or service sectors.

Under this scheme, women entrepreneurs can avail bank loans ranging from ₹10 lakh to ₹1 crore.

The loan amount can be used for business setup, machinery, infrastructure, or working capital.

Banks also provide handholding support during the loan application process.

This scheme aims to increase women participation in entrepreneurship and job creation.

Annapurna Scheme for Women

The Annapurna Scheme is designed for women involved in food-based businesses such as catering units, tiffin services, and small eateries.

It provides financial assistance to purchase raw materials, kitchen equipment, and utensils.

The loan amount is generally small and suitable for micro businesses.

Repayment terms are flexible based on income levels.

This scheme helps women become self-employed and improve their household income.

Udyogini Scheme for Women

The Udyogini Scheme supports women entrepreneurs from economically weaker sections by offering loans at low interest rates.

It aims to promote self-employment and small business activities among women.

Loan funds can be used for retail, agriculture, handicrafts, or service-related work.

Eligibility depends on income limits and age criteria.

This scheme helps women achieve financial stability and long-term independence.

Telangana State–Introduced Women Loan Schemes

Vaddi Leni Runalu – Interest-free loans provided by the Telangana government to Women Self-Help Groups (SHGs).

SHG ₹2 Lakh Loan Scheme – Women SHG members receive loans up to ₹2 lakh with major subsidy/waiver by the state.

Indiramma Mahila Shakti Scheme – Financial assistance to women for self-employment and small businesses.

Stree Nidhi Credit Cooperative – Low-interest, quick loans exclusively for SHG women members.

WE-Hub Telangana Support – State-run platform offering funding access, mentoring, and financial linkage for women entrepreneurs.

SHG Bank Loan Scheme (Central – NABARD) : Loan Amount & Interest

Central SHG Bank Loan (NABARD) is NOT zero-interest.

Banks charge interest, usually 7%–12% per year.

The government gives interest subvention, so effective interest can reduce to 7%, and up to 4% if repaid on time.

Completely interest-free loans are NOT central schemes.

Zero-interest loans are provided only by some State governments (like Telangana’s Vaddi Leni Runalu), not by the Centre.

Women Loans EMI Calculator

Monthly EMI: ₹0

Total Interest: ₹0

Total Payable: ₹0

■ Principal ■ Interest

Common Questions

Answers to your queries about government schemes for women.

Eligibility can vary based on the scheme, but generally includes age, income, and residency requirements. It’s best to check the specific details of each scheme for exact criteria.

You can apply online through the official government website or visit your local office for assistance. Ensure you have all necessary documents ready for a smooth application process.

Deadlines can vary based on the specific scheme. It’s important to check the official announcements or websites for the latest information.

Typically, you will need identity proof, address proof, and income statements. Some schemes may require additional documents, so make sure to check the specific requirements.

Yes, support is available. You can reach out to local help desks or use online resources that provide guidance. We’re also here to assist you with your application process.

For more details, you can visit government websites or trusted financial resources. We also provide updates and insights here to keep you informed.

Need more help?

If you still have questions, feel free to reach out. We’re here to support you.