Is Mudra Loan for Women?

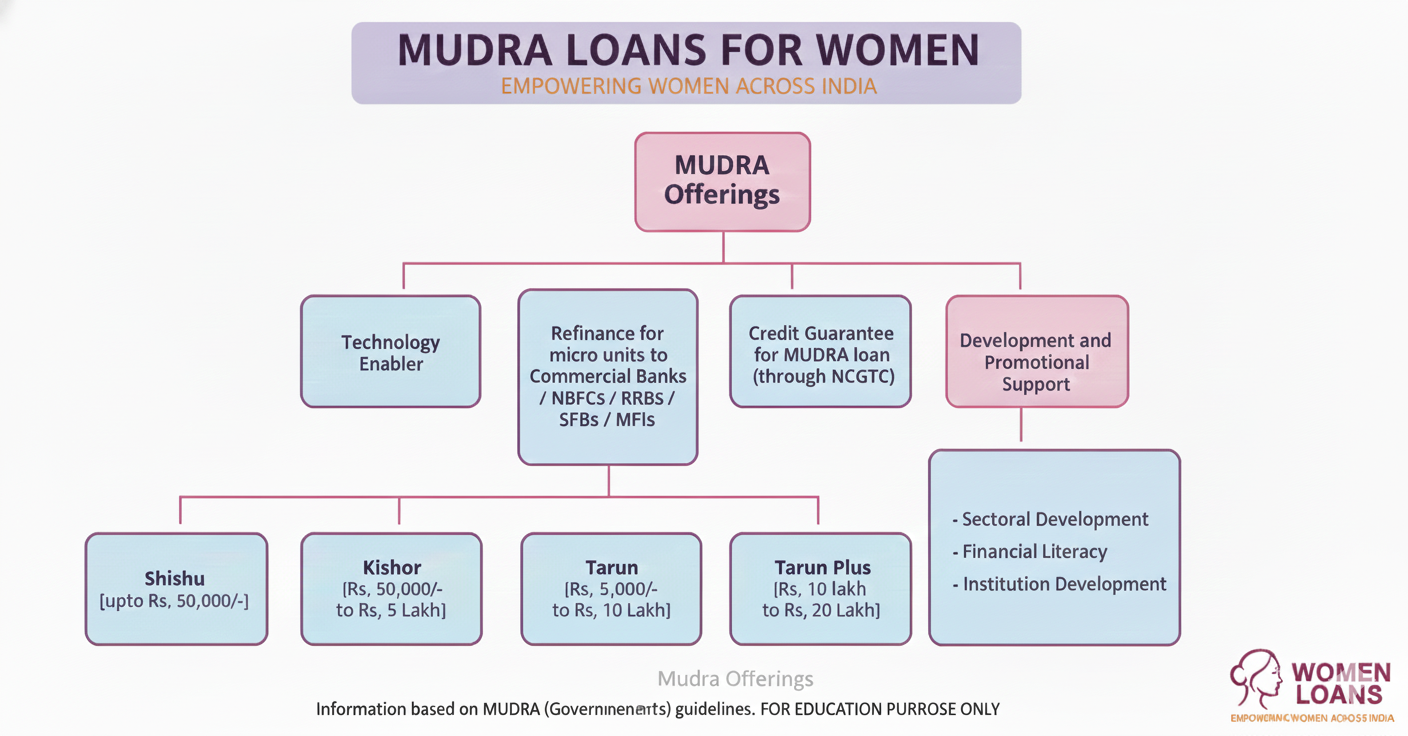

Mudra loan for women refers to loans provided under the Pradhan Mantri Mudra Yojana (PMMY) where women entrepreneurs are actively encouraged and often given priority to promote women-led enterprises. Launched by the Government of India in 2015, PMMY is a government-backed business loan scheme designed to support micro and small entrepreneurs across the country.

While the Mudra loan scheme is open to all eligible business owners, women entrepreneurs receive special focus under PMMY as part of the government’s initiative to increase women’s participation in business and self-employment. The scheme offers collateral-free credit for non-farm businesses in manufacturing, trading, and service sectors, helping women start, manage, or expand businesses with simple eligibility criteria and flexible repayment options.

Types of Mudra loans for Women

Shishu Mudra Loan (Up to ₹50,000)

The Shishu Mudra Loan is specially designed for first-time women entrepreneurs who want to start a small business with minimal investment. This category focuses on empowering women who may not have prior business experience or strong financial backgrounds. Women can use this loan to start home-based or micro businesses such as tailoring units, candle or agarbatti making, papad or pickle preparation, beauty services, mobile recharge shops, tuition classes, or small food tiffin services.

The documentation process for Shishu Mudra loans is simple, making it suitable for housewives, self-help group members, rural women, and women from economically weaker sections. Since the loan amount is small, banks usually do not require detailed financial records or GST registration. Repayment tenure is flexible, allowing women entrepreneurs to stabilize their income before repaying the loan comfortably. Shishu Mudra loans play a crucial role in helping women take their first step toward financial independence and self-employment.

Kishore Mudra Loan (₹50,001 to ₹5,00,000)

The Kishore Mudra Loan is ideal for women entrepreneurs who already run a small business and wish to expand, upgrade, or improve their operations. This category supports women-led enterprises such as boutiques, beauty salons, tailoring shops, online businesses, stationery stores, small retail outlets, tuition centers, and food processing units. Women can use the loan amount to purchase new machinery, increase inventory, renovate business premises, or hire additional staff.

Banks generally assess basic business performance, income stability, and repayment capacity before approving Kishore loans. Applicants may need to submit bank statements and a simple business plan. This category helps women transition from micro-level businesses to more organized and sustainable enterprises. Kishore Mudra loans are particularly useful for women who want to increase their monthly income, improve business quality, and build long-term financial stability through structured growth.

Tarun Mudra Loan (₹5,00,001 to ₹10,00,000)

The Tarun Mudra Loan is designed for established women entrepreneurs who require higher capital to expand their business operations. This category supports women running manufacturing units, service centers, wholesale trading businesses, clinics, coaching institutes, medium-scale retail outlets, and professional service firms. The loan amount can be used for business expansion, machinery purchase, technology upgrades, working capital needs, or opening additional branches.

Since the loan amount is significant, banks carefully evaluate business turnover, profitability, repayment history, and overall financial discipline. Applicants are usually required to submit financial statements, bank records, and future business projections. Tarun Mudra loans help women entrepreneurs scale their businesses, generate employment, and strengthen their market presence. This category is ideal for women who have proven business capability and are ready to move to the next stage of growth.

Tarun Plus Mudra Loan (₹10,00,001 to ₹20,00,000)

Tarun Plus Mudra Loan is the highest category under the Pradhan Mantri Mudra Yojana and is intended for high-growth women entrepreneurs with strong and consistent business performance. This category supports women-owned enterprises planning major expansion, diversification, or modernization. Suitable businesses include advanced manufacturing units, large retail chains, export-oriented businesses, logistics services, and professional service firms with stable revenues.

Banks conduct detailed assessments for Tarun Plus loans, including evaluation of financial statements, income tax returns, business projections, and credit history. Although the loan remains collateral-free under Mudra guidelines, strong financial discipline is essential for approval. Tarun Plus Mudra loans help women entrepreneurs transform their businesses into well-structured enterprises, contribute to employment generation, and play a significant role in India’s economic growth.

Eligibility Criteria for Mudra Loan for Women

Who Can Apply?

Any Indian woman entrepreneur who is planning to start a new business or currently running a small enterprise can apply for a Mudra loan. The scheme supports women engaged in non-farm income-generating activities, whether the business is home-based, small-scale, or in the early stages of growth. Women applicants can include first-time entrepreneurs, self-employed professionals, members of self-help groups, and women managing family-run businesses.

Mudra loans are available for both new and existing businesses, making the scheme suitable for women at different stages of their entrepreneurial journey. Even women without prior business experience can apply, provided they have a clear business idea and meet basic banking requirements. This inclusive approach ensures that women from urban, semi-urban, and rural areas can access financial support to become self-reliant.

Age Limit

To be eligible for a Mudra loan, the applicant must be at least 18 years old at the time of application. There is generally no strict upper age limit under the scheme; however, the maximum age may depend on the lending bank’s internal policies and the loan repayment tenure.

Banks may also consider the applicant’s ability to manage the business and repay the loan within the agreed period. For older applicants, lenders typically assess income stability and business viability before approving the loan. This flexible age requirement allows women from different age groups, including young entrepreneurs and experienced business owners, to benefit from the Mudra scheme.

Business Types Allowed

Mudra loans for women are available for a wide range of non-farm business activities. Eligible businesses Mudra loan for include manufacturing units, trading businesses, and service-based enterprises. Common examples include tailoring units, beauty salons, boutiques, retail shops, food processing units, catering services, tuition centers, daycare facilities, and small-scale manufacturing operations.

Home-based businesses, handicrafts, MSMEs, and women-led micro-enterprises are strongly encouraged under the scheme. However, agricultural activities such as crop cultivation are not covered under Mudra loans. The flexibility in eligible business types ensures that women entrepreneurs can use Mudra financing to support diverse business ideas, expand existing operations, and create sustainable sources of income.

Mudra Loan Interest Rates for Women

There is no fixed interest rate under the Pradhan Mantri Mudra Yojana (PMMY). Instead, interest rates for Mudra loans are determined by individual banks and NBFCs based on their internal lending policies and RBI guidelines. In most cases, Mudra loan interest rates generally range between 9% and 12% per annum, depending on the loan category, business profile, and credit assessment of the applicant.

Women borrowers often receive favourable consideration under the Mudra scheme as part of the government’s focus on promoting women-led enterprises. While PMMY itself does not mandate a separate interest rate exclusively for women, many banks offer concessional rates, priority processing, or flexible repayment options for women entrepreneurs. These benefits may vary across lenders and can depend on factors such as business stability, repayment capacity, and loan amount.

The interest rate applicable to a Mudra loan also depends on the chosen category—Shishu, Kishore, Tarun, or Tarun Plus. Smaller loans under the Shishu category may attract comparatively lower interest rates due to reduced risk, while higher loan amounts under Tarun or Tarun Plus may involve slightly higher rates based on detailed credit evaluation. Repayment tenure and loan usage also influence the final rate offered by the bank.

It is important for women applicants to compare interest rates and loan terms offered by different banks before applying. In addition to interest rates, borrowers should consider processing fees, repayment flexibility, and prepayment options. By choosing the right lender and maintaining a good banking record, women entrepreneurs can secure Mudra loans at competitive interest rates and manage their business finances effectively.

Documents Required for Mudra Loan for Women

Common Documents

Women applicants are required to submit a set of basic personal documents to establish identity and address. These commonly include Aadhaar card, PAN card, valid address proof such as Aadhaar, voter ID, passport, or utility bills, along with recent passport-size photographs. These documents help banks verify the applicant’s identity and ensure compliance with Know Your Customer (KYC) norms.

In addition to identity and address proof, applicants must provide a bank account linked to their Aadhaar and PAN. A clean and active bank account history improves approval chances, especially for higher loan amounts. While the documentation process is generally simple under Mudra loans, ensuring that all details are accurate and up to date helps avoid delays or rejection.

Business Documents

For women running an existing business, lenders may request basic business-related documents to assess business viability and repayment capacity. These documents typically include a brief business plan outlining the nature of the business, expected income, and loan usage. Recent bank account statements are required to review transaction history and cash flow.

GST registration may be required if the business turnover exceeds the prescribed limit, while Udyam (MSME) registration is often encouraged to avail additional benefits. Depending on the loan amount and category, some banks may also request income proof or previous loan details. Clear and organized business documentation helps banks process Mudra loan applications more efficiently.

For New Women Entrepreneurs

New women entrepreneurs and first-time business owners benefit from simplified documentation under the Mudra scheme. In most cases, a simple business proposal explaining the business idea, estimated expenses, and expected income is sufficient. Along with this, identity and address proof documents are required to complete the application process.

Since Mudra loans are designed to promote self-employment, banks do not usually insist on complex financial records or collateral for new entrepreneurs. This makes the scheme especially suitable for housewives, self-help group members, and women entering entrepreneurship for the first time. A clear business idea and honest documentation significantly improve approval chances.

How to Apply for Mudra Loan for Women Online

Step 1: Check Eligibility

Verify your eligibility based on business type, loan amount, and Mudra category.

Step 2: Choose Mudra Category

Select Shishu, Kishore, Tarun, or Tarun Plus based on your funding requirement.

Step 3: Submit Application

Submit your loan enquiry through the WomenLoans.in platform. We assist you with application guidance and documentation support, while the actual loan application, approval, and disbursement are handled directly by partner banks or NBFCs.

Step 4: Bank Verification

The bank evaluates your documents, business viability, and repayment capacity.

Step 5: Loan Disbursement

Once approved, the loan amount is credited directly to your bank account.

Mudra Loan for Women vs Other Government Schemes

Mudra Loan for Women works alongside other government schemes such as Stand-Up India, Annapurna Scheme, and Udyogini Scheme. These schemes provide additional funding options depending on the business scale, sector, and eligibility criteria.

Common Reasons Mudra Loan Applications Get Rejected

Incomplete Documentation

Missing or incorrect documents can delay or reject the application.

Unclear Business Plan

A weak or unrealistic business proposal reduces approval chances.

Poor Banking History

Previous loan defaults or irregular account activity may impact approval.

Incorrect Loan Category Selection

Choosing a Mudra category that does not match your business stage can lead to rejection.

FAQs – Mudra Loan for Women

Is Mudra loan only for women?

No, Mudra loans are open to all entrepreneurs, but women applicants receive special preference.

Can housewives apply for Mudra loan?

Yes, housewives can apply if they plan to start a business.

Is Mudra loan collateral free?

Yes, Mudra loans are completely collateral free.

How long does Mudra loan approval take?

Approval usually takes between 7 and 15 working days, depending on the bank.

Final Thoughts – Mudra Loan for Women

Mudra Loan for Women under the Pradhan Mantri Mudra Yojana is one of the most trusted government-backed business funding options in India. With easy eligibility, no collateral requirement, and flexible repayment terms, it empowers women entrepreneurs to build sustainable businesses and achieve financial independence.