An educational loan for women is a financial solution designed to help women pursue higher education without financial stress. In India, an educational loan for women offers special benefits such as lower interest rates, flexible repayment terms, and access to government-backed schemes that encourage women to achieve academic and career goals.

With growing emphasis on women’s education and skill development, banks and financial institutions actively support women students through tailored education loan options.

What Is an Educational Loan for Women

An educational loan for women is a type of education loan provided by banks, NBFCs, and government-supported institutions to finance academic expenses. These loans can be used for undergraduate, postgraduate, professional, technical, or vocational courses in India and abroad.

Compared to regular education loans, an educational loan for women often includes interest concessions, extended repayment flexibility, and eligibility benefits aimed at increasing women’s participation in higher education.

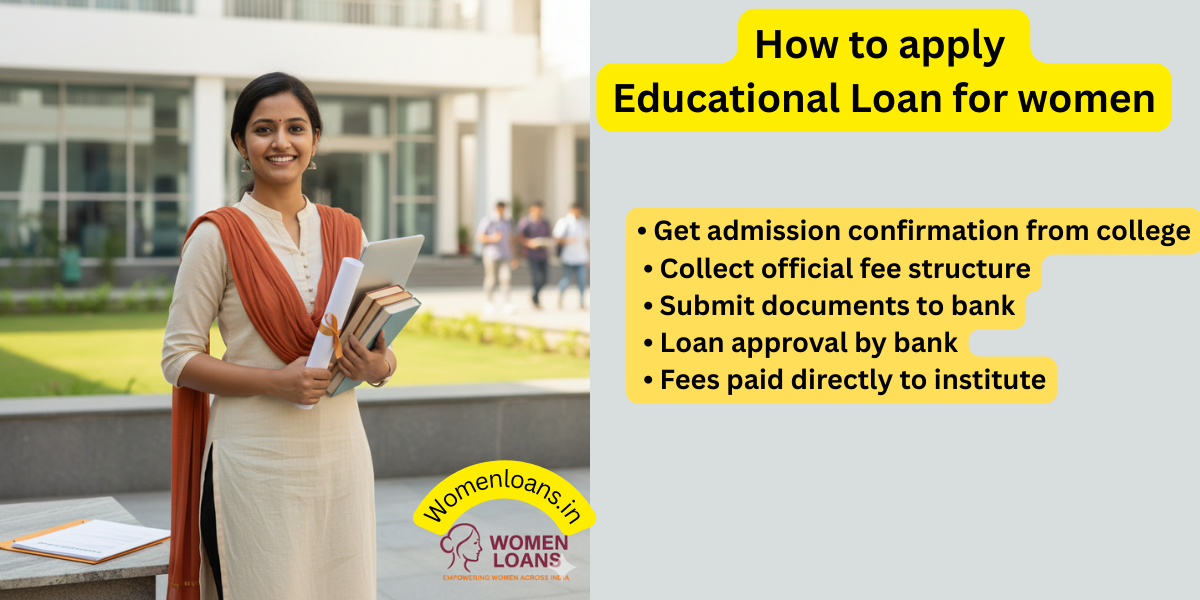

How to Avail an Educational Loan for Women

Applying for an educational loan for women involves a structured process. Following the correct steps improves approval chances and ensures smooth disbursal.

Step 1: Check Eligibility

The first step to avail an educational loan for women is checking eligibility. Lenders assess age, academic record, course type, institution recognition, and the co-applicant’s income and credit profile.

Step 2: Choose Loan Type

Women students can select an educational loan for women based on course level, location, and funding needs. Options include loans for studies in India, overseas education loans, and loans for professional or skill-based programs.

Step 3: Submit Application

After selecting the appropriate option, the applicant submits the educational loan for women application along with academic and financial documents. Once verified, the lender issues a sanction letter and disburses the loan as per fee schedules.

Eligibility Criteria for Educational Loan for Women

Eligibility criteria for an educational loan for women may vary by lender, but common requirements include Indian citizenship, confirmed admission to a recognized institution, and a co-applicant such as a parent or guardian with stable income.

Many lenders also consider academic merit and future employability when approving an educational loan for women.

Interest Rates on Educational Loan for Women

Interest rates on an educational loan for women are generally competitive and may include concessions of 0.25% to 0.50% compared to standard education loans. Rates typically range between 8% and 13% per annum depending on the lender, loan amount, and study destination.

Interest subsidies under government schemes further reduce the overall cost of an educational loan for women from economically weaker backgrounds.

Documents Required

To apply for an educational loan for women, applicants must submit essential documents such as identity proof, address proof, academic records, admission letter, fee structure, and co-applicant income proof.

For overseas studies, additional documents like passport, visa, and university accreditation may be required for an educational loan for women.

Government Schemes for Women Entrepreneurs

Women students applying for an educational loan for women can benefit from government initiatives such as the Central Sector Interest Subsidy Scheme and state-level education support programs.

These schemes aim to make higher education affordable by offering interest subsidies during the moratorium period for eligible educational loan for women applicants.

Benefits of Educational Loan for Women

An educational loan for women provides multiple benefits including lower interest rates, flexible repayment after course completion, moratorium periods, and access to government subsidies. Some lenders also offer extended repayment tenure and simplified processing for women applicants.

These advantages make an educational loan for women a valuable financial tool for building long-term career success and independence.

Conclusion

An educational loan for women plays a crucial role in empowering women through education and skill development. By understanding eligibility, interest rates, documentation, and available schemes, women can confidently choose the right education loan and invest in a brighter future.